SBA Extends COVID Economic Injury Disaster Loan Application Deadline

The United States Small Business Administration (SBA) recently announced that it extended the deadline for small businesses to apply for the Economic Injury Disaster Loan (EIDL) program, in association with the COVID-19 pandemic, to the end of 2021. The loans were presented last year as an additional option for struggling small businesses, along with the Paycheck Protection Program (PPP). U.S. Small businesses, nonprofits, and agricultural businesses are eligible for an EIDL if they have suffered "substantial economic injury" as a result of the coronavirus pandemic. According to the SBA, the full list of eligible applicants includes:

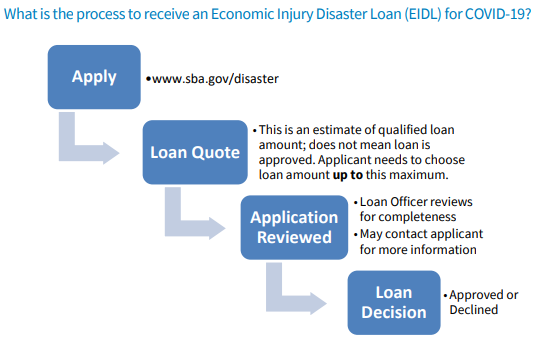

Image via SBA.gov Jovita Carranza, the SBA Administrator, said upon the deadline extension announcement, “Following the President’s declaration of the COVID-19 Pandemic, the SBA has approved over 3.6 million loans through our Economic Injury Disaster Loan program nationwide. The EIDL program has assisted millions of small businesses, including non-profit organizations, sole proprietors and independent contractors, from a wide array of industries and business sectors, to survive this very difficult economic environment.” The extension is part of a bipartisan COVID-19 relief bill passed by Congress and approved by the President in late December. At the time of the announcement, the SBA had approved $197 billion in low-interest loans, which are designed to provide working capital funds to businesses and organizations to help them survive the pandemic. The SBA did note the caveat that EIDL loan applications will continue to be accepted through December 2021 pending the availability of funds. The loans come with a 3.75 percent interest rate for small businesses and a 2.75 percent interest rate for nonprofit organizations, as well as a 30-year maturity and an automatic deferment of one year before monthly payments are due. The SBA has just announced the reopening of the PPP for new borrowers in addition to certain existing borrowers. Updated guidance discussing changes to the program was also released. This PPP round authorizes up to $284 billion for small businesses through March 31, and allows some existing PPP borrowers to apply for a Second Draw PPP Loan. Additionally, certain existing borrowers can request to modify their First Draw PPP Loan amount. Other updates to the PPP include greater flexibility for seasonal employees, the ability for borrowers to set their loan’s covered period to be any length between 8 and 24 weeks, coverage of additional expenses (including operations, expenditures, property damage, supplier costs, and worker protection), and the expansion of eligibility to include more types of organizations, including housing cooperatives and destination marketing organizations. Small businesses can apply for both a PPP loan and an EIDL, but funds from both cannot be used for the same purpose. Read other business articles |